Special Market Reports

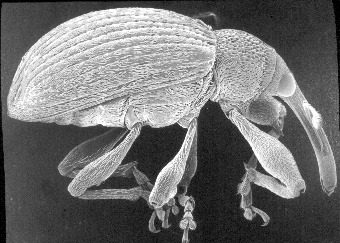

Oil Prices Could Be Our Boll Weevil

In the center of the old downtown in Enterprise, Alabama, in the middle of the main intersection, sits the Boll Weevil Monument. We’re not kidding, it is a real monument to an insect pest which damages cotton crops. I once lived in Enterprise while stationed at nearby Fort Rucker for helicopter flight training. A plaque mounted on the sidewalk nearby explains this historical monument’s purpose: “In profound appreciation of the Boll Weevil and what it has done as the herald of prosperity, this monument is erected by the citizens of Enterprise—December 11, 1919.”

This seems like a wacky and whimsical thing for a small town to do, especially in that part of the south where cotton farming was and is serious business. Of course, the story is a little bit more complicated than that. Starting in 1915, there was a terrible boll weevil infestation all across the southern states where cotton was grown as the main cash crop. Way back then, farmers did not have access to effective pesticides to deal with this sort of problem, and the situation in Alabama was made worse by the fact that so many farmers were growing cotton. That gave the boll weevil infestation a huge critical mass to get itself going, and also a uniform pathway to spread to surrounding areas. The start of WWI in 1914 also pushed up cotton prices.

Farmers there had also fallen into a pattern of growing only cotton because that was what they knew how to grow, and that was what the whole farming infrastructure was designed around. That concentration had a couple of bad effects. The first problem was that the soil was depleted over time from growing only one type of crop for the most part. The second problem was that the entire economy of that area was so thoroughly dependent upon the success of growing that one crop, and so crop failures of that one single type of crop made things really bad for the entire area, not just the farmers.

So things were pretty bad in Alabama beginning in 1915, and everyone was feeling terrible about things. Farmers saw no way to get out of their problems, with the boll weevils still so prevalent that even planting a new cotton crop seemed doomed to failure. And they really wanted to plant more cotton, because WWI and the widespread cotton crop failures were driving up cotton prices, as shown in the chart.

There had been spikes in cotton prices before, but the spike in the late 1910s was of a different sort. This chart shows that there were big spikes in cotton prices at the times of the War of 1812 and the Civil War, but those price spikes were understandable in light of the economic disruptions that wars always bring. The resolution of the crisis in the cotton market in each case was tied to the resolution of the wars. The 1915 boll weevil infestation was not a man-made event, and was a fairly new and disruptive phenomenon for the cotton farmers. It was different from the previous wartime spikes in cotton prices in that there was not an easily understandable resolution that the participants could envision, like ending a war.

In the midst of this crisis, along comes George Washington Carver, who was born into slavery around 1864 (accounts vary), and who went on to study horticulture and to teach at the Tuskegee Institute, which is not that many miles away from Enterprise. Even before the boll weevil infestation of 1915, Carver had been advocating the practice of alternating cotton with other crops such as legumes and sweet potatoes in order to help restore nitrogen to the depleted soil. Carver is often credited with having invented peanut butter, although he was not involved with that. Dr. Kellogg served peanut butter to the patients in his Battle Creek, Michigan sanitarium in the 1890s, and by 1914 several companies were already selling peanut butter (source: inventors.about.com).

What Carver did was to find other industrial uses for products that could be made from peanuts, including glues, dyes, soap, cooking oils and sauces, and printer’s ink. He also strongly advocated the growing of peanuts in order to provide a ready supply to industry for these uses. For this work, Carver was praised by Teddy Roosevelt in 1916, and made a member of England’s Royal Society of Arts (source: wikipedia.org). These innovations helped create a new sort of economy in the south, especially in southern Alabama, based on the growing and processing of peanuts. The effect for the area was to make farmers and others even better off than they were before when they only grew cotton. The introduction of the practice of crop rotation also helped to make the area’s cotton crops grow more abundantly because of the restoration of the depleted soil.

Farmers could have turned to other crops at any time before 1915, and gotten the soil benefit from crop rotation then, but there was not the established infrastructure for the use of those other crops, and there was also not the impetus to grow something else until the boll weevil came along and forced them out of their complacent situation. Thus, the boll weevil infestation acted as a catalyst for change, and ended up making things a lot better for that region and for the country as a whole after first making things a bit worse and forcing people to change. People would not have known that they could be better off were it not for having to face the problems brought by the boll weevil. In appreciation of that spark for a change, the city fathers in Enterprise decided to erect the Boll Weevil Monument as a way of recognizing what had happened, and also as a reminder not to allow themselves to get set in their ways just based on how everything has always been done.

Now, as an aside, it does say something about the state of society in Alabama in 1919 that the city fathers could have chosen to erect a monument to George Washington Carver, but instead decided to honor a bug. Race relations there have improved a lot since then. So, you ask, why are we bringing up all of this ancient history? The reason is that we see a lot of parallels between the situation in the cotton market in the 1910s and the oil market of today. Much of our economy now has been based on cheap and easily available crude oil supplies, and so there is a lot of turmoil going on right now with oil having risen from only $20/barrel as recently as 2002 to the current price of around $74/barrel. There have been past spikes in oil prices that were related to wars, as shown in the chart below. But this current upward surge in oil prices is not coming from war-related production shortages. Instead, it is the spreading of industrialization into countries like India and China, whose populations dwarf that of the U.S., and which are seeing increased use of crude oil in a variety of ways. This is not a crisis whose solution lies in just finishing the war, and so in that respect we are now facing a difficult situation somewhat akin to what the Alabama farmers faced in 1915. In other words, the oil markets are facing a sort of boll weevil infestation of another sort.

It is our fervent hope that the industrialized world will see a similar response to what the southern farmers and industrialists did. By that we mean that this crisis of higher oil prices could be the spark that the world needs to shock it out of its oil dependency, and cause us all to diversify our industry and our energy sources in such a way that we will end up better off than we were before. We know that this can be hard to imagine, but the parallel between these two crises is a good one.

So then the next question is this: how does this all relate to our purpose here in this newsletter, which is analyzing and timing the financial markets? The answer is that the people who profited the most in the 1915 boll weevil infestation were those who most nimbly adjusted to the new ways. The farm machinery dealers who sold equipment for the planting and harvesting of other crops did well. The industrialists who devoted time and capital to exploiting the new uses for peanuts and other crops did well.

Those who stuck to cotton did well initially, providing that they could produce it, because the boll weevil infestation caused cotton prices to move up quite a bit. But notice in that chart on page 8 that cotton prices crashed back down again in the early 1920s, so the people who hitched their fortunes to perpetually high cotton prices got burned over the years that followed.

But those who rode the wave of innovation did well, and continued to do well. So our key as investors is to learn from that and apply those lessons to the current oil price situation. That means that it is still appropriate for us as investors to find ways to profit from the high and still-rising oil prices. We continue to believe that we have another 9 months of uptrending oil prices as the echo of the big run up in gold prices that just ended in May. But when oil prices are up around $100 next year, the biggest mistake would be to hitch one’s portfolio to the prospect of perpetually high oil prices. Instead, we have to look for the peanuts and sweet potatoes of this oil crisis.

It is beyond the scope of our purpose here to define what those technologies will be. The message we want to get across is that it will be important for all of us as investors to figure out what the replacements will be, and to devote our attention and our capital to supporting them (and thereby profiting from them, of course).

The McClellan Market Report p. 8 & 9 Report #270, July 7, 2006, ©2006, McClellan Financial Publications, Inc.

Published since 1995, this 8 page newsletter covers the stock, bond, and gold markets and features interpretations of our unique technical indicators. A one-year subscription includes 24 issues of The McClellan Market Report. With your paid subscription, you will receive for free our booklet: Understanding Oscillators and Other Indicators.